It was a huge privilege to attend the 13th International Microinsurance Conference (IMC) in Lima, Peru, earlier in November and participate in a panel discussion on the role of actuaries in inclusive insurance. You may be wondering “What, actuaries in inclusive insurance? Are they even necessary for such simple, short-term covers?”. An interesting observation after having attended a number of the annual IMC’s is the slow but steady increase in participation from actuaries and organisations that provide actuarial services. The reason frequently expressed to me is that actuarial skills are necessary for the development of a sustainable inclusive insurance industry. The questions are rather when should actuarial skills be required, what level of skills are required and what roles should be performed by people with actuarial skills?

The answer to these questions lies in a single word: proportionality. Proportionality is a very simple concept and can be summarised as not using a sledgehammer to crack a nut, but also not arriving at a gun fight with only a knife. In other words, a proportional solution is one that appropriately takes account of the nature, scale and complexity of a problem. But what does proportionality with respect to actuarial services mean in the context of inclusive insurance? This is exactly what a joint project team between the International Actuarial Association (IAA) and the International Association of Insurance Supervisors (IAIS) has set out to achieve, which was also the topic of the panel discussion in Peru.

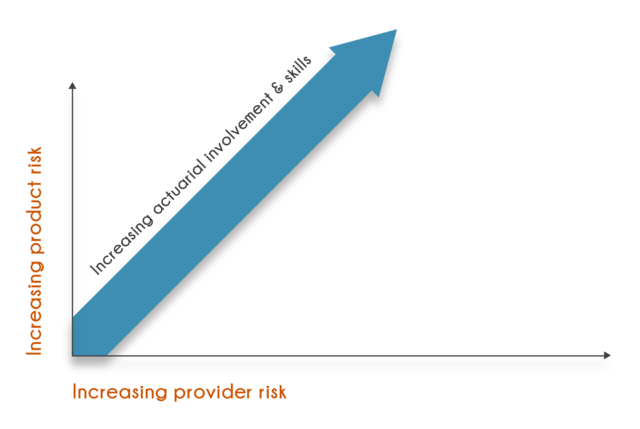

Broadly speaking, the extent of actuarial services required and the level of actuarial skills depends on two dimensions: the level of risk inherent in a particular product and the ability of the product provider to develop a product that is appropriate for the chosen target market and distribution channel and then manage the risks that will potentially emerge. This approach is illustrated in the following diagram.

For example, for a simple, low cover credit life product (assumed low product risk) sold by a well-managed insurance company with strong governance and controls (assumed low provider risk) it may be reasonable for someone with substantial technical insurance pricing and risk management experience to be involved in developing and managing the product even if they don’t have any formal actuarial training. However, a weather index insurance product will probably require a fully qualified actuary or similar technically qualified expert with substantial experience of index-based inclusive insurance products to price and manage the product, especially if the provider does not have strong management and governance structures.

The concepts presented at the IMC were met with substantial enthusiasm and support from both industry and supervisors, which is a strong endorsement for the work being done by the joint IAA – IAIS project team. As chair of the IAA’s Microinsurance Working Group, I’m looking forward to the project’s completion and publishing the papers and tools for industry and supervisors to use to assess the need for actuarial skills in inclusive insurance.