Inclusivity Solutions was recently privileged to win the Fintech and e-commerce award at Viva Technology awards in Paris and I thought I would share some reflections. I was particularly struck by the energy and focus on Africa which was truly an amazing surprise amongst Europe’s largest tech and startup event.

In fact, I lost my voice after the first 2 days due to the sheer amount of interest in what we were doing in embedded insurance which meant I wasn’t even able to attend any of the main sessions.

Thankfully I was supported by Benjamin Bonnell and Ida Michel (at short notice) who gave some cover on the stand to recover my voice, visit some of the other stands and present at the awards!

I also had the chance to speak after the award and used the opportunity to cover our Big 3 challenges (rather than the Big 5 game animals in Africa) which I expect are relevant to many startups and insurtechs playing in Africa.

The Big 3 are:

1) Sustainable scale (or monetization): we currently have an addressable customer base of 250m clients through our amazing partners in Africa across 8 countries. However, with penetration of insurance typically between 3–5% of the population across much of Africa there are significant headwinds to driving revenue due to the lack of frictionless payments at the core (which I have covered ad nauseum), but also trust and consumer awareness which we are solving for through a mix of technology and other mechanisms.

2) Business development: insurance is all about scale as a B2B2C insurtech. But enterprise sales is slow, as we all know. So whilst we continue to solve for (1) we continue to push for new partners who want to build out embedded insurance and digital insurance businesses, whether distribution partners or insurers. With our Open APIs and no code platform we can launch products within hours, so technology is not the delaying factor and we have proven we can launch with new partners and new markets at marginal cost.

3) Fundraising: The last of the big 3 is, no surprise, fundraising. As any founder knows, fundraising is tough. And focusing on the insurance and insurtech vertical makes it even harder. In fact that is the reason I chose insurance as it was the financial product furthest from the tipping point of scale in Africa but, done well, it can have huge social impact. IF it is done well. And fundraising is particularly slow during this funding winter which, despite rumours of thawing, is still not fully in a funding spring. So I welcomed the conversations with investors focused on Africa and emerging markets.

It was an amazing week filled with a significant number of good conversations at the conference and the side events. So whilst still ‘jet lagged’ after the event (and I didn’t even attend GITEX the following week like many in Paris!) I still feel inspired by the energy and drive that we witnessed. So now back to focusing on building Embedded Insurance Solutions for an Emerging Africa.

Related Posts

Thrilled to be nominated at the African Banker Awards for Fintech of the Year, 2024

Thrilled to be nominated at the African Banker Awards for Fintech of the Year! The…

Runner up in GFMD14 Summit’s 4th IOE-Seedstars Migration Challenge in Geneva

The Inclusivity Solutions team is beaming with pride, excitement and renewed passion this morning 🚀…

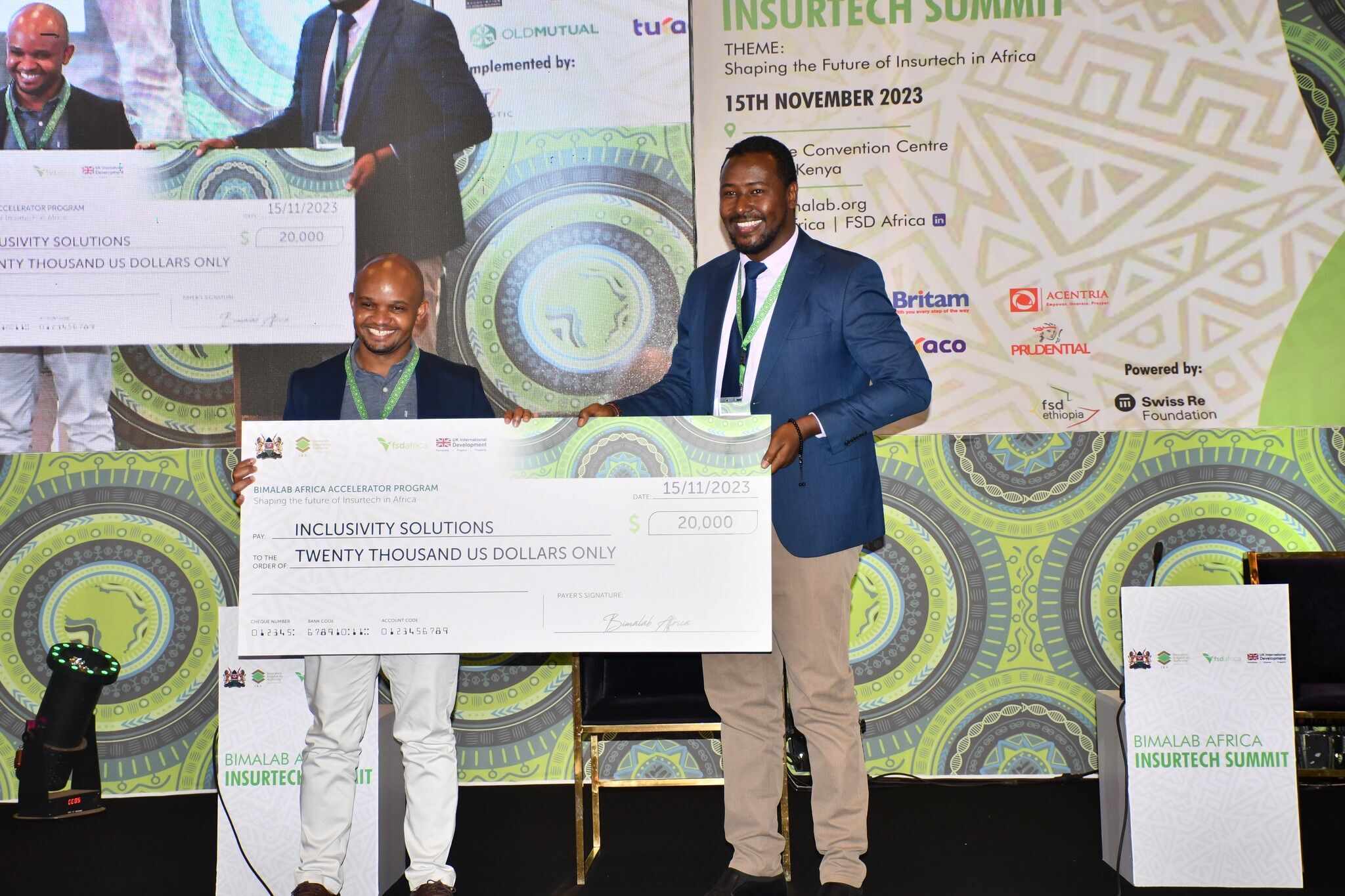

Inclusivity Solutions is a proud winner of the BimaLab Africa 2023 accelerator program

Honoured to share that Inclusivity Solutions is a proud winner of the BimaLab Africa 2023…

Goodwell leads USD 1.5 million extension round for emerging market insurtech Inclusivity Solutions

Amsterdam, the Netherlands, 30 October – Impact investor Goodwell Investments is pleased to announce the…