Inclusivity Solutions is a B2B2C insurtech that designs and delivers embedded insurance solutions for emerging African consumers

Customers

Monthly Policies

Countries

Partners

We currently operate in 10 countries, but we can expand our operations to any location our partners desire.

Botswana

Ghana

Kenya

Malawi

Rwanda

South Africa

Uganda

Zambia

We collaborate with leading banks, insurers, MFIs, telcos and innovative fintechs across the continent

Our solution combines our award-winning digital insurance platform, ASPin, supported by Open APIs to enable insurers and distribution partners to get to market fast. This is supported by our consumer, analytics and actuarial specialist services to create and deliver ‘best-fit’ insurance products for our partners

For Distribution Partners

We enable you to seamlessly embed insurance into your core product or service.

Insurance, when done well, can drive a range of positive outcomes for your business

Attract New Customer

Retain existing Customer

Drive New Revenue Streams

Enhance Efficiency and customer satisfaction

Improve brand and social impact

Drive more profitable consumer behaviour

Through our Open API-based digital insurance platform ASPin, combined with specialist insurance expertise, we can seamlessly embed insurance into your products and services to safeguard what matters most to your consumers.

For Insurers, Brokers and Bancassurance

Use our agile, and scalable insurance platform ASPin as a policy administration system

Our Open API based digital insurance platform can help unlock the value of digital partnerships and accelerate the go-to-market for a new generation of digital insurance products.

From sales to policy administration and premium collections to claims, our platform unlocks the business case for low-cost digital insurance.

cover the top risks faced by emerging consumers

What partners are saying

I had heard about Inclusivity Solutions but had never worked together till I joined my current organization. They are omni-present in all the touch points of my business, a fact that I attribute to their high-caliber workforce. They are agile, sensitive, responsive and have been extremely helpful not only in technology, but other aspects of the business. Inclusivity’s 360-degree view of the business is fantastic. Choosing them as a partner is one of the decisions, I will pride myself for, for a very longtime.

Dennis Victor Wafula

Head, Insurance and Investments – Airtel Money Africa

We continue to be inspired by Inclusivity Solution’s commitment to their mission of inclusive insurance. They understand the difficulties of the mission yet have stayed the course and have what it takes to travel it. And we know that, when the world finally gets to that promised land, Inclusivity Solutions will be counted as one of the team that got us there.

Dare Okoudjou

Founder & CEO, MFS Africa

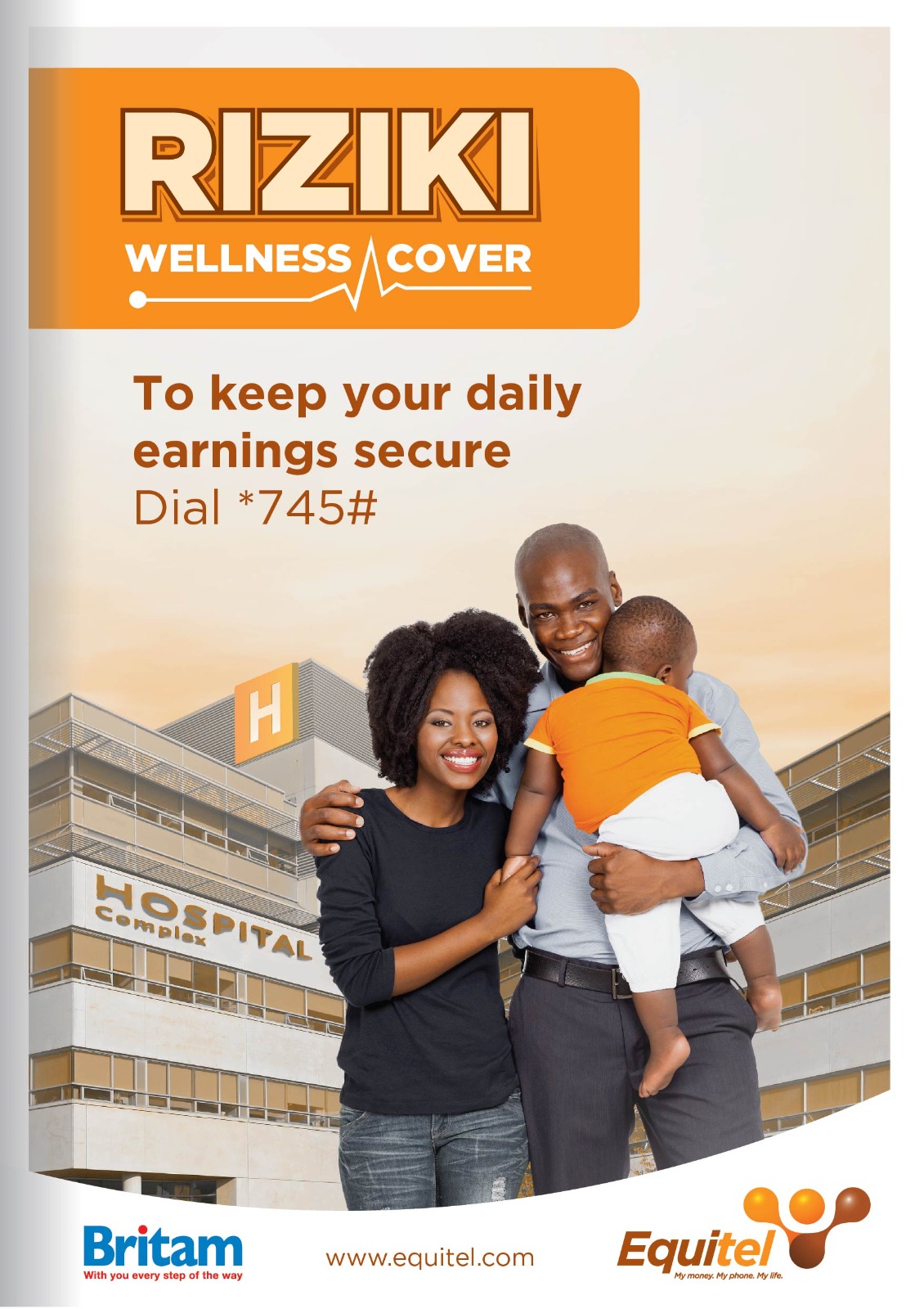

Inclusivity Solutions’ ASPin platform and product expertise has allowed Britam to accelerate and scale its footprint in the Kenyan microinsurance market. We have seen significant improvements in customer onboarding, transparency, and operational efficiency

Saurabh Sharma

Director, Britam Microinsurance

The Inclusivity Solutions selling point is that it is more than just a platform provider, it is a true partner which we can build a digital business with by leveraging their Africa specific experience from a tech and commercial point of view

Erich Gariseb

Former Executive Head: Products and Distribution (Africa), Momentum Metropolitan Holdings Limited

Inclusivity Solutions is led by insurance and technology veterans with deep experience in distribution and emerging markets

Case Study - Onafriq | Rwanda

Driving significant uplift in remittance transactions

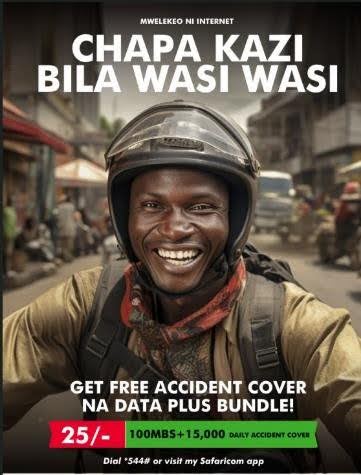

Case Study - Safaricom | Kenya

Driving additional revenue and differentiation

Case Study -Real People MFI I Kenya

Reducing portfolio at risk and improving financial security of MSMEs

Case Study - Equitel | Kenya