Britam Insurance, Airtel Money, and Inclusivity Solutions, have partnered to introduce a range of mobile insurance solutions targeting lower income families and Micro, Small, and Medium Enterprises (MSMEs). The partnership aims to provide protection to these underserved segments of the population against several risks, including loss of income due to hospitalization, death or disability caused by accident, and funeral costs in the event of death from natural causes or accident.

The partnership will enable customers to access three innovative insurance products through their mobile phones: Hospital Cash, Last Expense and Personal Accident covers or a combination of the three.

The Hospital Cash (Hospi-cash) cover provides policyholders with a daily cash benefit of Ksh500 per day for a hospitalization period of three or more days, up to a maximum of 30 days per year. This insurance coverage protects against loss of income and medical expenses, with premiums starting as low as Ksh35 per month for individuals or Ksh170 for a family of up to four members.

Additionally, the Last Expense cover is designed to alleviate the financial burden associated with funeral costs in the event of the assured’s death. This solution offers a lumpsum payout of Ksh100,000 to beneficiaries to cover income loss, outstanding bills, and burial expenses, with premiums starting at Ksh40 per month for individuals or Ksh170 for a family of up to four members.

Meanwhile, the Personal Accident cover safeguards policyholders in the event of permanent disability or death resulting from an accident. This solution provides a pre-determined payout of Ksh100,000 to the assured or their next of kin. Premiums for the Personal Accident cover start at Ksh35 per month for individuals or Ksh150 for a family of up to four members.

Alternatively, clients can choose “Combo”, which is a comprehensive cover that combines all the three products: Hospi-Cash, Last Expense, and Personal Accident, into one package for customers who want to enjoy the full benefits of insurance. Combo can be purchased for as low as Ksh100 per month for individuals and Ksh420 for families.

- Personal Accident Cover available at a monthly fee of Ksh35 for individuals and Ksh150 for families.

- Hospital Cash (Hospicash) Cover at a monthly fee of Ksh 40 for individuals and Ksh170 for families.

- Last Expense Cover at a monthly fee of Ksh40 for individuals and Ksh170 for families.

- Combo Benefit that combines Hospital Cash, Accidental/ Natural Death and Permanent Total Disability covers at a monthly fee of Ksh100 for individuals, and Ksh420 for families.

To purchase any of the insurance covers, clients can simply dial *334# from their Airtel line and select their preferred option. Monthly payments can be made conveniently through the Airtel Money Wallet into Britam’s account.

The claims process is equally hassle-free. Customers can initiate a claim by dialing *334# from their Airtel line, and a dedicated representative will guide them through the process. For Hospicash claims, customers need to submit a hospital discharge letter, hospital invoice, and hospital receipts.

Personal accident claims require a medical report from a doctor and a hospital discharge summary. While Last Expense Cover claims, require the submission of a copy of the deceased’s identity card, copy of the claimant’s identity card, and a burial permit.

BRITAM INSURANCE SAYS VALID CLAIMS WILL BE SETTLED WITHIN 72 HOURS FROM THE RECEIPT OF ALL NECESSARY DOCUMENTS.

“Through this partnership, we aim to reach out to millions of Kenyans who do not have access to formal insurance and provide them with protection against various risks that can affect their livelihoods and well-being,” said Britam’s Director of Partnerships and Digital, Evah Kimani, speaking during the launch of the partnership.

Airtel Money Kenya Managing Director, Anne Kinuthia – Otieno, said by leveraging on Airtel Money, the partnership is revolutionizing the insurance landscape, making it more accessible, efficient, and customer friendly.

While Inclusivity Solutions CEO, Indira Gopalakrishna, expressed her delight at the partnership and opportunity to anchor the technology behind the innovative digital solution. “Our award-winning digital insurance platform enables us to easily launch embedded insurance products and we are excited to bring this innovative product to customers in Kenya” she said.

Related Posts

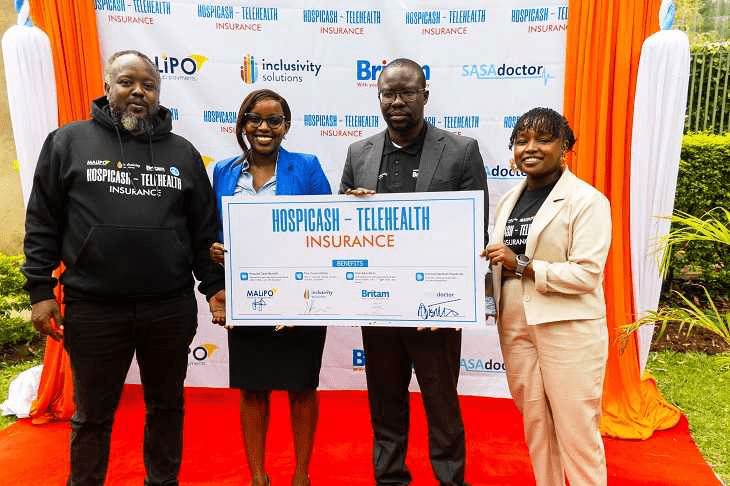

New Partnership Launch: Women’s Healthcare Protection in Kenya

In partnership with Malipo Circles LTD, Britam, and SASAdoctor, we have introduced an affordable healthcare…

Partner Launch: Thanzi Medical Aid

Another Step Towards Universal Health Coverage in Africa

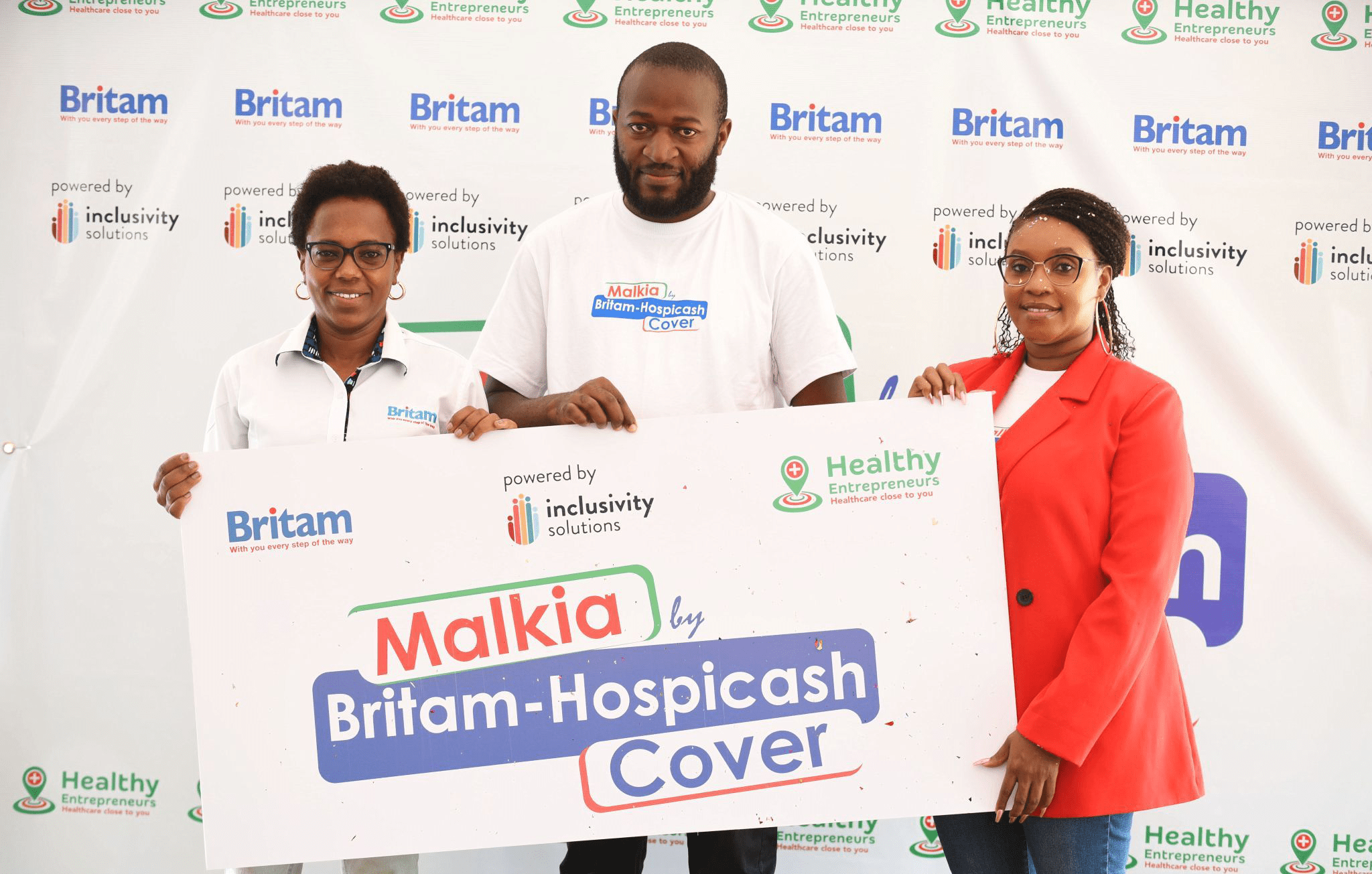

New Partner Launch: Inclusive Healthcare for Women Entrepreneurs

Advancing Health and Financial Resilience for Women Microentrepreneurs in Kenya

New Product Launch: Ingoboka Kashi

We're thrilled to announce the launch of Ingoboka Kashi—a revolutionary embedded digital insurance product—developed through…