Technology and Science Minister Felix Mutati has hailed ABSA Life, Airtel money, and Inclusivity firms for the creation of a potent solution at the digital distribution model umuyo funeral cover driven by innovative technology, collaboration and partnership.

Mr. Mutati said the partnership is devised on the digital technological front that is introduced to administer and cover life insurance for customer service – satisfaction round the clock.

Speaking during the re-launch of ABSA’s Life Zambia’s micro-insurance umoyo funeral cover plan in partnership with Airtel money and Inclusivity firms, Minister Mutati said the launched cost effective product is convenient as it can be easily accessed on the spot distinct from physical point of search for service.

“In the face of increased development of digital services, questions about the quality and standards that meets customer satisfaction remains a big challenge. In fact, we are faced with a challenge of most not meeting the standard that is being set today. This I say because we are going to witness the launch of a digital distribution model by some of powerful brands not just in Zambia but at sub-regional level. This partnership will not only benefit absa customers but all airtel customers as well. If you have heard me on several platfoms talk about partnerships and collaborations, this is it. From the outset, I can only say congratulations to absa and airtel!Ladies and gentlemen,one of the key measurements of a growing economy is easy access to financial services for its population. Financial services as we know vary from mainstream banking, wealth, and investment to insurance and over the years, we have seen significant digital uplift of financial services in the banking sector, where customers can now complete transactions on their mobile phones that previously required a series of approvals and steps at a physical branch.”

“Today we are witnessing the expansion of such services to insurance. With this product offering, customers will be able to acquire insurance from the comfort of their homes, offices and even while on the street by simply accessing the service on the airtel money platform using used. Ladies and gentlemen,this government has emphasised time and again how financial inclusion is a key strategic agenda and working with the financial industry regulators such as the bank of zambia, the insurers association of Zambia and the pensions and insurance authority with the support of other organisations, we are beginning to see this benefit expand not just to high income earners, but to the lower sections of our communities and primarily those in the informal sector. We are living in a world that is constantly evolving with new exciting and innovative technology and it is therefore comforting to see that absa life is embarking on a journey to be digitally led. I believe such a strategy will result in efficiencies that will grow not just the insurance industry, but the country as a whole. Recognising that your customers are spending more time on their digital gadgets,” he said.

Mr. Mutati continued:”The government is creating an enabling policy environment for the development and uptake of digital services. We need to adopt digital services for the simple reasons of convenience and efficiency of the services, cost savings in the use of platforms, inclusion and equality for the marginalized groups.Ladies and gentlemen,at our ministry, we believe that technology is the foundation for economic growth and sustainability. As we have recently come to experience, a significant number of our people in Zambia both young and old are adopting the many tools and applications available for use on their mobile phones and other gadgets not just for social interaction but also for financial transactions.”

“It is therefore only right that insurance must also be accessible through the same tools and applications. It is gratifying to see the culmination of the absa life Zambia and airtel mobile commerce Zambia (airtel money) partnership powered by inclusivity solutions that is driving the digital advancement agenda through the distribution of the micro-insurance umoyo funeral cover which will be beneficial to all airtel subscribers.A few years ago, it would have been impossible to imagine an insurance distribution model of this kind in zambia, however, technology has made this possible and we hope that we will see a lot more of such products coming out of this model.Ladies and gentlemen,it is important to note that both absa and airtel are pan african brands that are providing a wide range of products and services to millions of customers not only in Zambia but across the continent, as such, I have all the confidence that this partnership will be able to meet its objectives and work with the Zambian government for the growth of our economy.Once again, I congratulate absa life zambia and airtel money on this milestone,” he said.

Pensions and Insurance Authority (PIA) manager policy and analysis Namakau Ntini said it was gratifying that the insurance regulator knows that ABSA, Airtel money, and Inclusivity customers are going to be an integral part of this roadmap – partnership.

Ms. Ntini said that previously the uptake of insurance suffered a hindrance due to lack of access however with such an implementation of a digital initiative funeral cover service the aspect of inclusion is realized for customers.

Airtel managing director Manu Sood said the established solutions initiated on partnership is a stepping stone for the telecom firm hence collectively effecting umoyo funeral cover product – service reaching people in far flung areas across the country. Mr Sood said his company was looking forward to interrogate more innovations.

ABSA Life managing director Collins Hamusonde said this collaboration is also driving the use of digital platforms to service customers.

Mr. Hamusonde said the umuyo funeral cover will benefit families to cushion impacts that comes with unexpected loss of beloved ones.

Source

https://www.lusakatimes.com/2023/05/18/minister-felix-mutati-praises-absa-life-and-airtel-money-partnership-for-innovative-funeral-cover-solution/

Related Posts

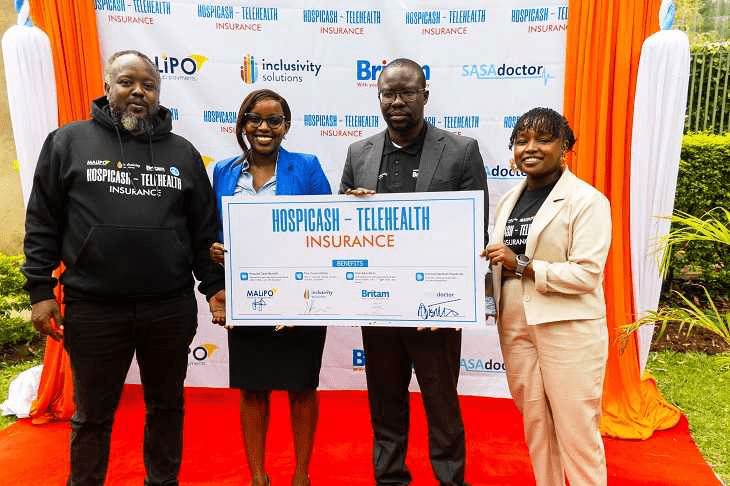

New Partnership Launch: Women’s Healthcare Protection in Kenya

In partnership with Malipo Circles LTD, Britam, and SASAdoctor, we have introduced an affordable healthcare…

Partner Launch: Thanzi Medical Aid

Another Step Towards Universal Health Coverage in Africa

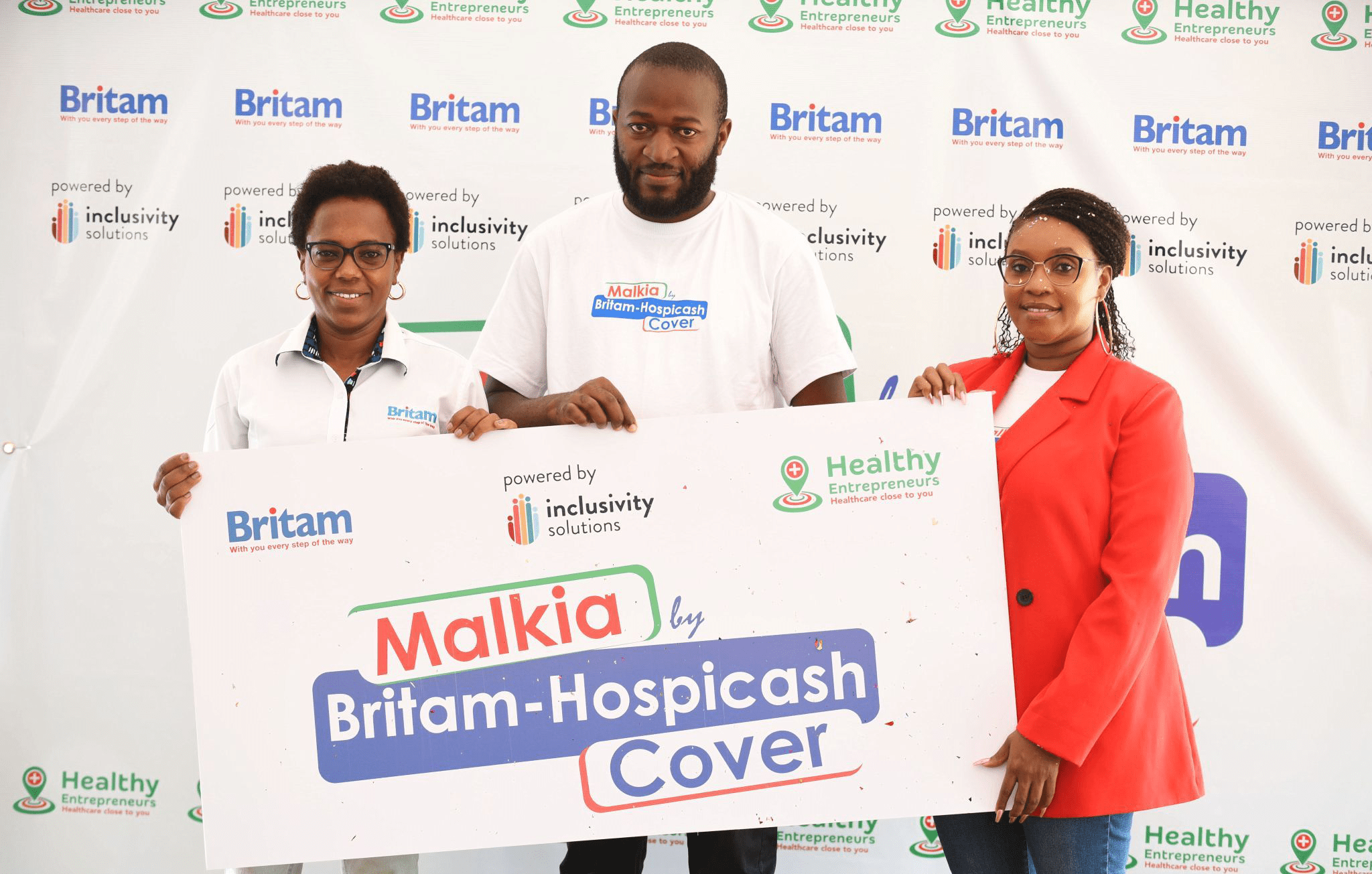

New Partner Launch: Inclusive Healthcare for Women Entrepreneurs

Advancing Health and Financial Resilience for Women Microentrepreneurs in Kenya

New Product Launch: Ingoboka Kashi

We're thrilled to announce the launch of Ingoboka Kashi—a revolutionary embedded digital insurance product—developed through…