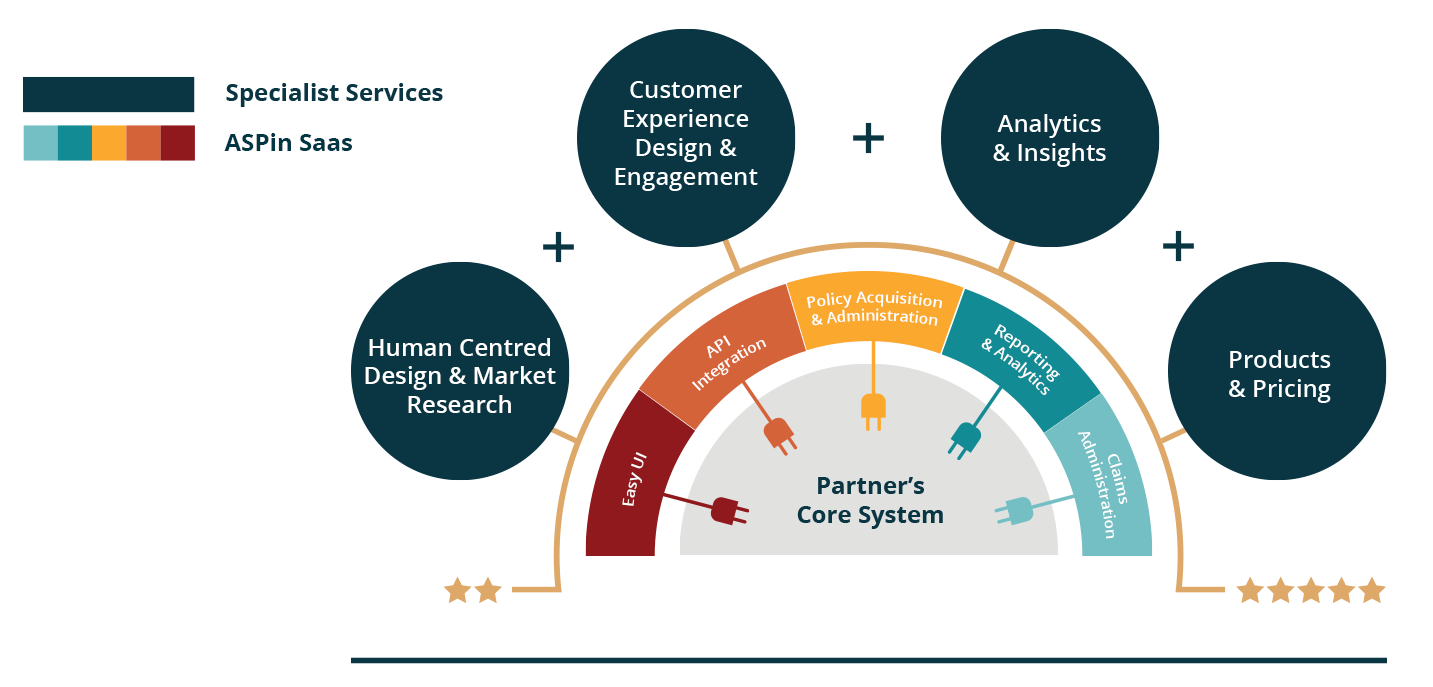

Our solution combines our award-winning digital insurance platform, ASPin, supported by Open APIs to enable insurers and distribution partners to get to market fast. This is supported by our consumer, analytics and actuarial specialist services to create and deliver ‘best-fit’ insurance products for our partners

For Distribution Partners

We enable you to seamlessly embed insurance into your core product or service.

Insurance, when done well, can drive a range of positive outcomes for your business

Attract New Customer

Retain existing Customer

Drive New Revenue Streams

Enhance Efficiency and customer satisfaction

Improve brand and social impact

Drive more profitable consumer behaviour

Through our Open API-based digital insurance platform ASPin, combined with specialist insurance expertise, we can seamlessly embed insurance into your products and services to safeguard what matters most to your consumers.

For Insurers, Brokers and Bancassurance

Use our agile, and scalable insurance platform ASPin as a policy administration system

Our Open API based digital insurance platform can help unlock the value of digital partnerships and accelerate the go-to-market for a new generation of digital insurance products.

From sales to policy administration and premium collections to claims, our platform unlocks the business case for low-cost digital insurance.

While our products are unique in each market, they generally follow one of two models

Partner-Funded Premium Model(Loyalty)

Distribution partner covers the cost of the premium

- Offered free to customers

- Used as a reward to drive customer behaviour such as increased savings or airtime usage

Customer-Funded Premium Model(Paid/Upsell)

Customer covers the cost of the premium

- Can be offered either as an upsell to loyalty cover or a direct to paid product

- Offered as a stand-alone or bundled product to existing clients

Loyalty Insurance

Per customer qualifying for loyalty cover

$0.05 - 0.50

Customer Funded Insurance

Per Month

$2 - $10

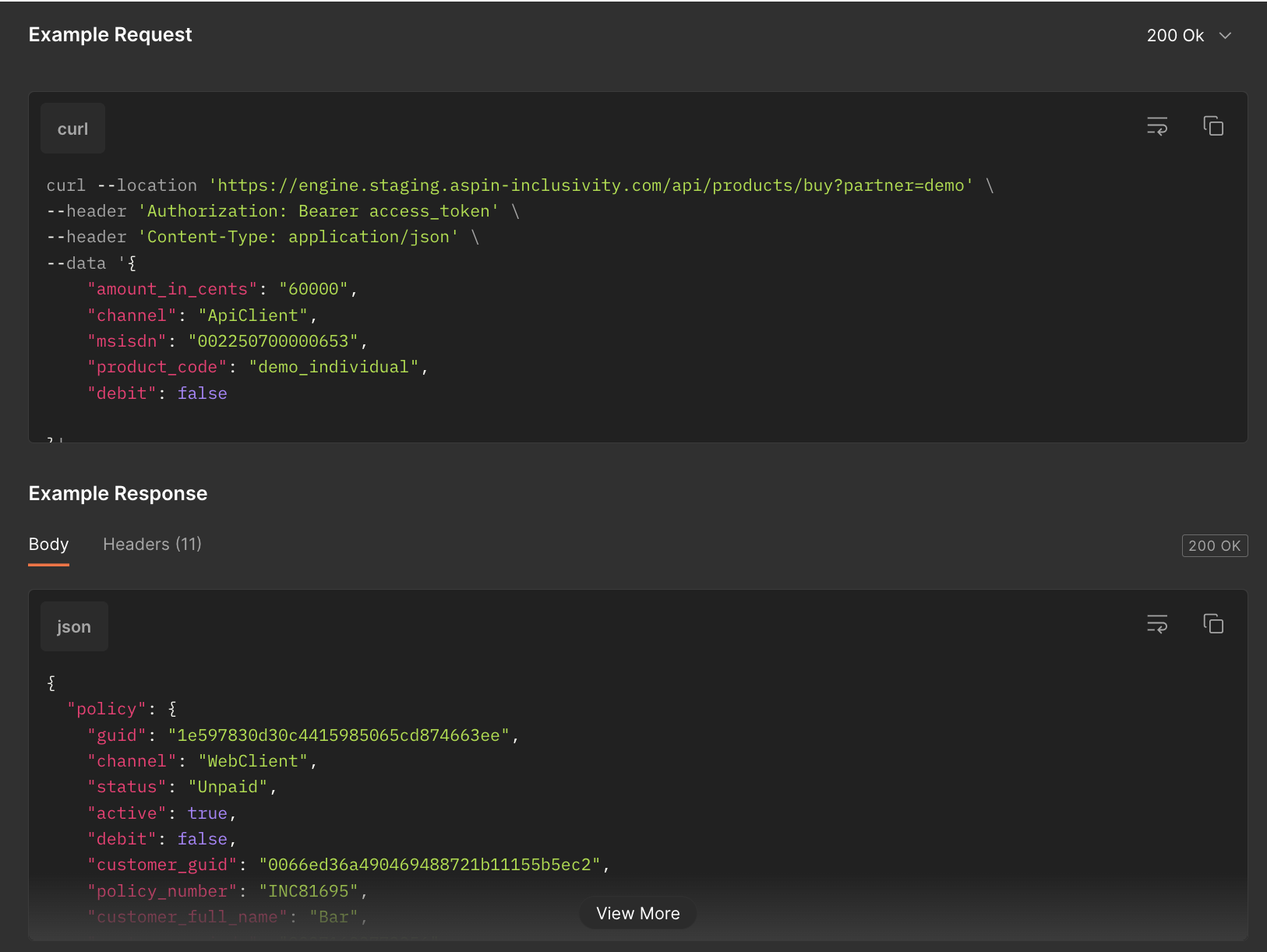

View our ready to plug-in

and simple to use

insurance APIs

Health

Includes hospital cash and personal accident

MSME Cover

Benefit paid for various risks faced by MSMEs

Loss of Income Cover

Benefit paid in event operations are interrupted by fire, storm/flood or impact by external forces.

Personal Accident

Benefit paid in the event of injuries,disability or death caused accidentally

Life

Simple life products covering expenses such as education, funerals and loss of life

Life / Funeral

Benefit paid in event of death

Property Assistance Cover

Benefit paid in the event of business assets destruction by fire,storm/flood or impact by external forces

Property

Protection for individuals and small businesses from losses to property, as well as device cover

Hospital Cash

Benefit paid per night of hospitalisation

Third Party Motor

Benefit paid in the event of damage to other people’s property or injury of other member

Medical Cover

Benefit paid for inpatient hospital expenses

Device Cover

Benefit paid in the event of theft or damage of phone, tablet, laptop etc

Home Contents Cover

Benefit paid in event of loss or damage of home possessions